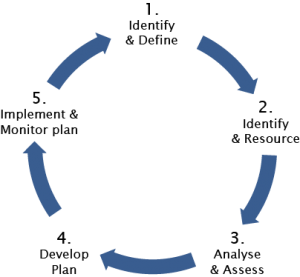

Our approach to wealth management is that we strive to provide high quality, bespoke, professional and trustworthy service for our clients by developing a comprehensive financial plan to meet your needs. In return we want clients with whom we can build a mutually profitable long term relationship.

To do this we essentially wear three hats

First Hat – The Life planner

The first hat we wear is that of a Life planner. A Life planners job is to identify exactly where you are now, how you got to where you are now, and more important, where you want to get to in the next 5, 10, 15 and 20 years. In fact, what it is you want to do between now and the day you die! Life is not a rehearsal and precious time is slipping away, our job therefore is to identify exactly what sort of life you want and in particular the type of lifestyle you want to enjoy.

Second hat – The Financial planner

Now we need to know what you want to achieve, to do this we will take off our Life planners hat and put on our second ‘Financial Planners’ hat. The financial planner’s job is to identify all of the financial resources available to you now and all of the resources that will become available to you in the future and more importantly all of the resources that you might need to become available in order to satisfy the needs of your life plan.

When we have all this information, we put together a comprehensive plan which will show you what your financial future looks like, what action you might need to take to achieve your goals/desired lifestyle and to maintain your desired lifestyle.

Third hat – Independent Financial Adviser (IFA)

Finally, when you have agreed on a financial plan and IF any financial products are needed to help satisfy the needs of your financial plan and only then will we take off our Financial planners hat and put on our third hat which is the Independent financial advisers hat, in order to identify which financial products or investments from the whole of the market should be implemented to achieve your goals.

So as you can see, we do things a little differently to most advisers. Being an IFA is the least important part of my job I do, when I eventually do that part of the job, I will be doing it knowing and understanding what you are trying to achieve, therefore any products or investments recommended, if any, will be recommended for all the right reasons, not because it seemed like a good idea at the time.

Mission Statement

‘Our mission is to help our clients and their families attain financial peace of mind. To provide the most appropriate solutions for their individual needs, with the aim of providing a service that as a minimum meets, and where possible, exceeds clients’ expectations’

We believe that Treating Customers Fairly is about delivering a fair outcome to our clients whilst offering a first class business service. It is embedded in the culture of our firm and our clients can be assured of this as:

- We are open about the way we carry out our business and how we are remunerated.

- We welcome and actively seek client feedback on a regular basis.

- We encourage all our staff to continue with their professional development.

- Our business is our clients, we never forget that.

We look at all areas of our business on a regular basis to ensure that:

- Clients can be confident that they are dealing with a firm where the fair treatment of clients is central to our firm’s culture.

- We consider our clients when promoting new services and products and ensure that it is relevant to them.

- Our clients are provided with clear information and we keep them informed before, during, and after the point of sale.

- Where advice is provided, we take time to understand our clients’ situation and ensure that our advice is suitable and appropriate.

- We meet our client’s expectations, providing them with a level of service and products that is of are of an acceptable standard.

- We will ensure that our clients can switch providers, change products, surrender policies and make any complaints without any undue barriers.